The Tipping Point

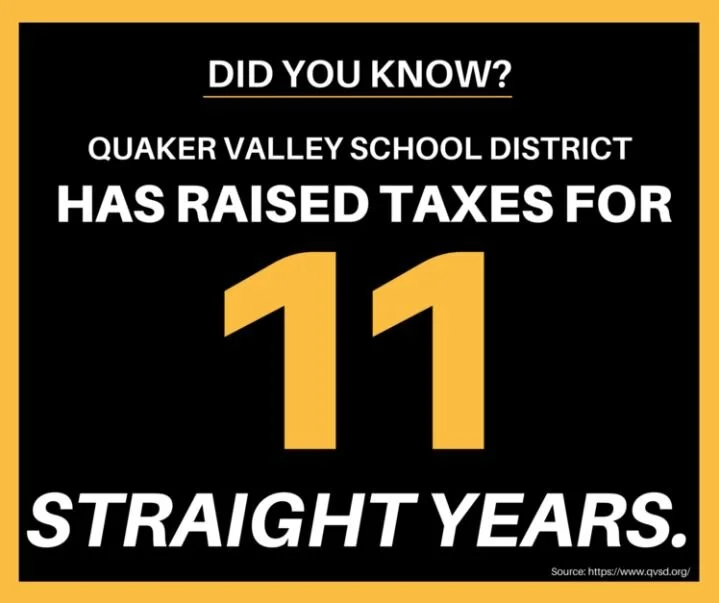

Over the last 5 years, QVSD’s property taxes have increased 12% - but that’s not the worst part. Their new plans include a 15.65% tax increase, for the next 30 years. Tax increases such as these have real and direct impacts on the lives of QV residents - like our elderly population - and our property values.

What can we afford?

Quaker Valley has a large amount of debt for a school its size—approximately $67m. It has large unfunded pension fund liability of approximately $70m. The documents that you will find below show the historical rise in millage—tax increases every year for the last nine. There is debt information in the audits, budgets and recent bond offerings.

We show a comparison of debt service per student between QV and other schools in the area. Finally, we have gathered recent budgets and the currently proposed budget. We believe that under the current economic circumstances the School Board should carefully reconsider any planned tax increase and its overall expenditure level.